COVID-19

Chamber COVID-19 Resources

The Highland County Chamber of Commerce is offering this page as a health and economic resource guide during the coronavirus pandemic. Please check back often as we plan to update the page frequently.

UPDATED 6/30/22 3:54 pm

The Chamber encourages you to continue to support our Members. Our full business directory has member contact information for you to learn more.

Reopening Resources

The Central Shenandoah Health District (CSHD) has opened a local COVID-19 hotline to answer questions and provide information about COVID-19 and related issues, including vaccines, testing, symptoms, how to minimize the risk of exposure for yourself and your loved ones, local and statewide transmission conditions, and more.

The hotline has public health experts on the line Monday through Friday from 8:00 a.m. until 4:30 p.m. Call 1-855-949-8378 to connect.

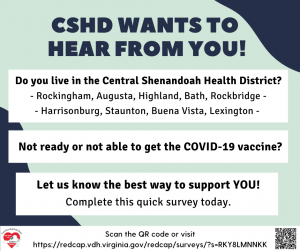

If you live in the Central Shenandoah Health District (Rockingham, Augusta, Highland, Bath, Rockbridge, Harrisonburg, Staunton, Beuna Vista, and Lexington), and are not ready or able to get the COVID-19 vaccine, CSHD wants your input!

Complete this quick, anonymous survey to let CSHD know the best way to support you: https://redcap.vdh.virginia.gov/redcap/surveys/?s=RKY8LMNNKK

|

May 28, 2021 information from Tim Abbott, Environmental Health Specialist, Sr., Virginia Department of Health, Bath & Highland Co. Health Departments

Phone/Bath(540) 839-7246

Phone/Highland (540) 468 – 2270

timothy.abbott@vdh.virginia.gov

This email serves as a reminder that Executive Order 79 goes into effect tonight at midnight (when you wake up tomorrow it will be effective!).

Although capacity limits, distancing, and other business requirements are fully lifted when EO 79 goes into effect, VDH continues to encourage businesses and other establishments to follow VDH/CDC recommendations and best practices for masking, distancing, handwashing, cleaning, symptom screening, ventilation etc. We have added new guidance, VDH General Recommendations for Businesses, to reflect these changes. For more detailed prevention and mitigation guidance for specific sectors (such as schools, sports, camps, pools, etc), continue to refer to VDH Website for Schools, Workplaces, and Communities and also CDC guidance.

Regarding masking, mask recommendations/requirements will continue to be posted and updated on the VDH mask page: www.vdh.virginia.gov/coronavirus/cloth-face-covers/. Our topline message is individuals who are not fully vaccinated should continue to mask and remain physically distanced in most settings. Individuals who are fully vaccinated, may remove their mask in most settings. CDC continues to recommend universal masking (regardless of vaccination status) in schools, child care settings, healthcare settings, homeless shelters, and correctional facilities. Regardless of vaccination status, individuals must also continue to wear a mask while accessing public transportation, per a federal requirement.

Additional requirements for employees and employers can be found in the Department of Labor and Industry’s Final Permanent Standard for Infectious Disease Prevention of the SARS- CoV-2 Virus that Causes COVID-19. DOLI FAQ’s may be found here.

The only mask “mandate” that remains in Executive Order 79 pertains to K-12 schools. Masks must be worn by all students, faculty, staff, and visitors (regardless of vaccination status) in public and private K-12 indoor school settings. This mandate includes activities beyond education (e.g. voters, attendees at performances, etc. on school property must wear a mask in accordance with EO 79). For outdoor K-12 school settings, please see the Governor’s FAQ, which clarifies that while outside on school property, students, teachers, staff, and visitors may remove their masks if fully vaccinated, and individuals who are not fully vaccinated may remove them outside if they can maintain at least six feet distance.

VDH General FAQs and the Executive Order Complaint Portal are also being updated and will reflect changes in Executive Order 79 tomorrow.

Full press release at www.governor.virginia.gov/newsroom/all-releases/2021/may/headline-895235-en.html.

Contacts: Office of the Governor: Alena Yarmosky, Alena.Yarmosky@governor.virginia.gov

Governor Northam Lifts Mask Mandate to Align with CDC Guidance, Announces Virginia to End COVID-19 Mitigation Measures on May 28

Commonwealth has administered nearly 7 million vaccines, 63 percent of Virginia adults have received at least one dose

RICHMOND—Governor Ralph Northam today lifted Virginia’s universal indoor mask mandate to align with new guidance from the Centers for Disease Control and Prevention (CDC). Governor Northam also announced that Virginia will ease all distancing and capacity restrictions on Friday, May 28, two weeks earlier than planned. The updates to Virginia’s mask policy are reflected in amendments to Executive Order Seventy-Two and will become effective at midnight tonight along with previously announced changes to mitigation measures.

Governor Northam made the announcement in a new video message.

Virginia is able to take these steps as a result of increasing vaccination rates, dramatically declining COVID-19 cases, hospitalizations, and statewide test positivity rate, and revised federal guidelines.

“Virginians have been working hard, and we are seeing the results in our strong vaccine numbers and dramatically lowered case counts,” said Governor Northam. “That’s why we can safely move up the timeline for lifting mitigation measures in Virginia. I strongly urge any Virginian who is not yet vaccinated to do so—the vaccines are the best way to protect yourself and your community from COVID-19. The message is clear: vaccinations are how we put this pandemic in the rearview mirror and get back to being with the people we love and doing the things we have missed.”

The CDC guidelines state that fully-vaccinated individuals do not have to wear masks in most indoor settings, except on public transit, in health care facilities, and in congregate settings. Businesses retain the ability to require masks in their establishments. Employees who work in certain business sectors—including restaurants, retail, fitness, personal care, and entertainment—must continue to wear masks unless fully vaccinated, per CDC guidance. Those who are unvaccinated or not fully-vaccinated are strongly encouraged to wear masks in all settings.

The state of emergency in Virginia will remain in place at least through June 30 to provide flexibility for local government and support ongoing COVID-19 vaccination efforts. Governor Northam will take executive action to ensure individuals have the option to wear masks up to and after that date. Masks will continue to be required in K-12 public schools, given low rates of vaccination among children.

To encourage all Virginians to take advantage of available COVID-19 vaccines, Governor Northam is inviting Virginians to participate in the “It’s Our Shot, Virginia: Statewide Day of Action” on Tuesday, May 18.

Virginians can take part in the Day of Action by:

- Signing up to be a COVID Community Ambassador. Ambassador will help share COVID-19 updates and materials from top experts and sources with their networks and in their local community. Sign up to become a COVID Community Ambassador here.

- Sharing your vaccination story on social media. Add a Facebook profile photo frame, upload a backdrop to your next virtual meeting, or record a short video highlighting why you chose to get vaccinated using the hashtag #VaccinateVirginia.

Virginia has administered nearly 7 million doses of COVID-19 vaccines. More than 4 million people have received at least one dose of the vaccine, representing over 63 percent of Virginia’s adult population. Governor Northam has said he remains confident the Commonwealth will meet President Biden’s goal of having 70 percent of adults vaccinated with at least one dose by July 4.

COVID-19 cases, hospitalizations, and the percent of positive tests continue to fall throughout the Commonwealth. Virginia is currently reporting a positivity rate of 3.5 percent, which is lower than at any time since the start of the pandemic. The Commonwealth’s seven-day average of new cases is 555, the lowest number in over 10 months. Virginia is currently recording its lowest number of COVID-19 hospitalizations at 684. For additional data on COVID-19 on Virginia and vaccination efforts, please see the Virginia Department of Health’s data dashboards.

Virginians over the age of 12 can schedule a vaccination appointment by visiting vaccinate.virginia.gov or calling 877-VAX-IN-VA (877-829-4682, TTY users call 7-1-1). Beginning Monday, May 17, the call center hours will change to 8 a.m. until 6 p.m., Monday through Saturday.

The full text of Seventh Amended Executive Order Seventy-Two and Order of Public Health Emergency Nine, which takes effect on May 15, can be found here.

The full text of Executive Order Seventy-Nine, which takes effect on Friday, May 28, can be found here.

Visit virginia.gov/coronavirus/forwardvirginia for more information and answers to frequently asked questions.

# # #

May 10, 2021 from Population Health Community Coordinator, Laura Lee Wight, for the CSHD:

The Central Shenandoah Health District (CSHD) is excited to announce that CSHD will be offering mobile COVID-19 vaccine clinics in the community in an effort to increase access to COVID-19 vaccines. To succeed in these efforts, we need your help!

If your organization or business is interested in a COVID-19 vaccine clinic for your community, then please complete this request form. You can also go to https://redcap.link/32fiylbj. Our mobile clinics can be walk-up with no registration needed and can be flexible in date and time of clinics. Our clinics can serve anywhere from 20-200 people. This service is free and available to all community members.

For some inspiration, a mobile clinic could be held at:

- a local festival, event, block party, farmers market, etc.

- a business, church, community center

- a food pantry, homeless shelters

- a park or public space

If interested, please complete the form and I will reach back out to you within 3-4 business days. Please share with other community members that may be interested in this service. A link to this request form will be available on our website at https://www.vdh.virginia.gov/central-shenandoah/covid-19-vaccine-information/.

If you have any questions about this initiative, please don't hesitate to call me at 540-430-1699 or email at laura.wight@vdh.virginia.gov.

Thank you for your support as we strive to keep our community safe and well.

4/30/21 (Communications from the Virginia Department of Health, Bath and Highland County Health Departments): See the below press release regarding the newly amended EO72 effective today and the 7th Amended EO effective May 15.

Changes that went in effect today:

• Increase to the cap on spectators for outdoor recreational sports from 500 to 1,000 per field.

• Individuals at public and private outdoor gatherings (weddings, funerals, celebrations, etc.) are to follow the CDC recommendations for masks. This means persons who are fully vaccinated, are no longer required to wear a mask if unable to maintain at least six feet of physical distance from other individuals who are not family members. Vaccinated individuals are in effect added to the exceptions of when masks are required, though that is not explicitly stated in the EO. NOTE: Sector specific guidelines requiring masks for both patrons and employees govern. Restaurant patrons must still wear masks over their nose and mouth outside, except while eating and drinking.

Contacts: Office of the Governor: Alena Yarmosky, Alena.Yarmosky@governor.virginia.gov

Governor Northam Updates Mask Guidance to Align with CDC Changes

RICHMOND—Governor Ralph Northam today amended Executive Order Seventy-Two to adopt new guidance from the Centers for Disease Control and Prevention (CDC) on mask use in outdoor settings. The CDC guidelines state that fully vaccinated individuals do not have to wear masks outdoors when alone or in small gatherings. Mask use is still required indoors and outdoors at large crowded events like concerts, sporting events, and graduation ceremonies. People are considered fully vaccinated two weeks after receiving the last required dose of vaccine.

“The CDC’s recommendations underscore what we have said all along—vaccinations are the way we will put this pandemic behind us and get back to normal life,” said Governor Northam. “Our increasing vaccination rate and decreasing number of new COVID-19 cases has made it possible to ease mitigation measures in a thoughtful and measured manner. I encourage all Virginians who have not yet received the vaccine to make an appointment today.”

The Governor also revised Executive Order Seventy-Two to allow up to 1,000 spectators for outdoor recreational sports, effective immediately. This change advances by two weeks a change that was scheduled to go into effect on May 15 and will allow additional spectators to participate in final games of the current high school sports season and the summer sports season.

Governor Northam reiterated that the next steps to ease mitigation measures will go into effect on Saturday, May 15 as previously announced. He expects to be able to roll back the remaining capacity limits in mid-June as long as the Commonwealth’s health metrics remain stable and vaccination progress continues.

More than 3.7 million Virginians have been vaccinated with at least one dose, representing 57 percent of Virginia’s adult population, and 2.5 million Virginians are fully vaccinated, representing 39 percent of the adult population. Virginians over the age of 16 can schedule a vaccination appointment by visiting vaccinate.virginia.gov or calling 877-VAX-IN-VA (877-829-4682, TTY users call 7-1-1).

The full text of Sixth Amended Executive Order Seventy-Two and Order of Public Health Emergency Nine is available here. Updated guidelines for specific sectors can be found here.

The full text of Seventh Amended Executive Order Seventy-Two and Order of Public Health Emergency Nine, which takes effect on May 15, can be found here.

Visit virginia.gov/coronavirus/forwardvirginia for more information and answers to frequently asked questions.

# # #

-

Contacts: Office of the Governor: Alena Yarmosky, Alena.Yarmosky@governor.virginia.govAs Vaccinations Rise, Governor Northam Announces Expanded Capacity, Social Gathering Limits to Begin May 15

More than half of all adults in Virginia have received at least one dose of the COVID-19 vaccine

RICHMOND—Governor Ralph Northam today announced that sports and entertainment venues in Virginia may begin to operate with expanded capacity, and social gathering limits will increase beginning Saturday, May 15th. The announcement comes as vaccinations continue to rise in the Commonwealth, and more than half of all adults have received at least one dose of the COVID-19 vaccine. All Virginians age 16 and older are now eligible to for the vaccine.

Governor Northam made the announcement in a new video message.

“It’s good news that half of all adults in Virginia have gotten a shot so far,” Governor Northam said. “Vaccination numbers are up, and our COVID-19 case numbers are substantially lower than they were earlier this year. So, we have been able to begin easing some mitigation measures. We took a few more targeted steps this week, and we will do more next month.”

“I’m optimistic that we will be able to take more steps in June. We are working to significantly ramp up vaccinations even further and aim to reduce capacity limits in June, hopefully all the way. But some things need to continue—we all need to keep wearing masks, social distancing, and encouraging each other to get a shot. It’s how we take care of one another.”

The Governor also reminded Virginians that getting vaccinated keeps communities safer, and allows expanded personal activities—for example, people who have been fully vaccinated do not have to quarantine after an exposure, per guidelines from the Centers for Disease Control and Prevention.

The Commonwealth will continue to mandate mask-wearing and social distancing, even as commercial restrictions are further eased. Key changes in the Sixth Amended Executive Order Seventy-Two will go into effect in about three weeks and include:

- Social gatherings: The maximum number of individuals permitted in a social gathering will increase to 100 people for indoor settings and 250 people for outdoor settings. Social gatherings are currently limited to 50 people indoors and 100 people outdoors.

- Entertainment venues: Indoor entertainment and public amusement venues will be able to operate at 50 percent capacity or 1,000 people, up from 30 percent capacity or 500 people. Outdoor venues will be able to operate at 50 percent capacity—up from 30 percent—with no specific cap on the number of attendees.

- Recreational sporting events: The number of spectators allowed at indoor recreational sporting events will increase from 100 to 250 spectators or 50 percent capacity, whichever is less. Outdoor recreational sporting events will increase from 500 to 1,000 people or 50 percent capacity, whichever is less.

- Alcohol sales: Restaurants may return to selling alcohol after midnight, and dining room closures will no longer be required between midnight and 5:00 a.m.

The full text of Sixth Amended Executive Order Seventy-Two and Order of Public Health Emergency Nine is available here. Updated guidelines for specific sectors can be found here.

Earlier this week Governor Northam made minor changes to the existing mitigation measures, including increased accommodations for cross-country events, school-based fine arts performances, and expanded access to bar seating in restaurants with strict social distancing. These changes are reflected in the current Fifth Amended Executive Order Seventy-Two available here.

Visit virginia.gov/coronavirus/forwardvirginia for more information and answers to frequently asked questions.

Virginia has now administered more than 5.5 million doses of the COVID-19 vaccine and is currently giving almost 77,000 shots per day. Over 3.5 million people have received at least one dose of the vaccine, more than half of all adults in Virginia and more than 40 percent of the total population.

Virginians over the age of 16 can schedule an appointment for vaccination by visiting vaccinate.virginia.gov or calling 877-VAX-IN-VA (877-829-4682, TTY users call 7-1-1).

# # #

Virginia Department of Health COVID-19 Vaccination Information:

https://www.vdh.virginia.gov/covid-19-vaccine/

2/17/21 Governor Ralph Northam invited Virginians to pre-register for the COVID-19 vaccine online at vaccinate.virginia.gov or by calling 877-VAX-IN-VA. The Commonwealth’s new, centralized system allows individuals to easily pre-register for the free vaccine, confirm that they are on the wait list, and learn more about Virginia’s vaccination program.

“Virginians have questions about the COVID-19 vaccines, and these new tools will help them get answers, get pre-registered, and most importantly, get vaccinated,” said Governor Northam. “While our vaccine supply remains limited, we are doing everything we can to acquire more doses and put shots into the arms of eligible individuals in a safe, efficient, and equitable manner. I thank everyone for staying patient and continuing to follow public health guidance so we can mitigate the spread of this dangerous virus.”

For the full press release, please visit: https://www.governor.virginia.gov/newsroom/all-releases/2021/february/headline-892800-en.html

1/11/21 From the Virginia Restaurant, Lodging and Travel Assocation (VRLTA): VDH has launched a new website where individuals can get more information and sign up for alerts based on their occupation, age, medical history, etc. This website is available BY CLICKING HERE. VRLTA is encouraging you to sign up now to get updates and help VDH plan for vaccination efforts.

1/7/21 COVID-19 INFORMATION UPDATE from the Virginia Chamber of Commerce:

This week, Governor Northam provided his first COVID-19 pandemic update of 2021. The health crisis remains critical with cases at the highest point since the first reported case in March 2020. According to statistical modeling conducted by the University of Virginia, cases will continue to rise through Valentine’s Day.

Broad immunization will be the key to getting Virginia past this pandemic. According to Governor Northam:

• Virginia needs a total of 17 million doses of the vaccine; that amount covers all 8.5 million Virginians, with two doses each.

• The current short-term goal for Virginia is to vaccinate 25,000 people per day, with a longer-term goal of 50,000 vaccinations.

Northam also announced his plan for prioritizing the administration of vaccines. Developed with recommendations from the CDC, the priority 1 group includes three categories (A, B and C) which includes health care professionals, long-term care facilities and assisted living facilities. Also included are essential workers who are at high risk of exposure or work in occupations that do not allow them to work from home. This includes firefighters, police officers, teachers and childcare workers, bus drivers, grocery workers, and mail carriers. Individuals aged 75 years first, and then 65 and older and those with compromised immune systems are also included. The priority groups account for approximately 4.2 million Virginians. The priority groups can be found on the VDH website at: www.vdh.virginia.gov/covid-19-vaccine/.

The Governor encouraged Virginians to get the vaccine and noted thousands of providers have registered with the CDC and over one hundred pharmacies have entered into agreements to administer the vaccine.

The Governor announced the appointment of Dr. Danny Avula to lead the vaccination effort in Virginia. Dr. Avula will be coordinating efforts between local health departments, private providers, key state personnel, and hospitals. The National Guard will also be tasked with coordinating logistics and administering the vaccine.

The following information was provided by FEMA (Federal Emergency Management Agency):

The FEMA How to Help page provides various ways to submit donations or offers of assistance on a national level and the National Business Emergency Operations Center (NBEOC) posts up-to-date fact sheets and guidance on their Dashboard.

The CDC has a website tracking the vaccinations in the United States that is searchable by state. You can also learn more about the vaccine, including information on training, storage, and general administration if you or your staff have questions.

The CDC also created the COVID-19 Vaccination Communication Toolkit for Essential Workers to help employers build confidence in this important new vaccine. The toolkit will help employers across various industries, including child care, educate their workforce about COVID-19 vaccines, raise awareness about the benefits of vaccination, and address common questions and concerns. The toolkit contains a variety of resources including:

- key messages,

- an educational slide deck,

- FAQs,

- posters/flyers,

- newsletter content,

- a plain language vaccine factsheet (available in several different languages),

- a template letter for employees,

- social media content, and

- vaccination sticker templates.

Full Release at https://www.governor.virginia.gov/newsroom/all-releases/2021/march/headline-893995-en.html.

Contacts: Office of the Governor: Alena Yarmosky, Alena.Yarmosky@governor.virginia.gov

Governor Northam Announces Limited Capacity Increases for Indoor and Outdoor Gatherings, Some Entertainment Venues as Vaccinations Rise

Approximately one in four Virginians vaccinated with at least one dose

RICHMOND—Governor Ralph Northam today announced that as COVID-19 vaccinations continue to rise in Virginia, certain sports and entertainment venues may begin to operate with additional capacity and indoor and outdoor gathering limits will increase starting Thursday, April 1. He amended Executive Order Seventy-Two with the next steps of the “Forward Virginia” plan to safely and gradually ease public health restrictions while mitigating the spread of the virus. More than two million Virginians, or approximately one in four people, have now received at least one dose of the COVID-19 vaccine.

“With increased vaccination capacity and our health metrics continuing to trend the right direction, we can safely take these targeted steps to ease certain mitigation measures,” said Governor Northam. “Virginians have come so far over the past year, and now is not the time to simply throw the doors open or let down our guard. While some capacity limits will be increased, we must all remember to stay vigilant and work together to protect ourselves, our loved ones, and our communities.”

The Commonwealth will maintain a Safer at Home strategy with continued mitigation strategies like physical distancing, teleworking, and universal mask requirements. Key changes in the Fourth Amended Executive Order Seventy-Two include:

- Social gatherings: The maximum number of individuals permitted in a social gathering will increase to 50 people for indoor settings and 100 people for outdoor settings. Social gatherings are currently limited to 10 people indoors and 25 people outdoors.

- Entertainment venues: All indoor and outdoor entertainment and public amusement venues must continue to operate at 30 percent capacity. Indoor venues must operate at 30 percent capacity or with a maximum of 500 people, an increase from the current cap of 250 people. Outdoor venues must operate at 30 percent capacity, with no specific cap on the number of attendees. These venues were previously limited to 30 percent capacity or up to 1,000 attendees, whichever was fewer.

- Recreational sporting events: The number of spectators allowed at recreational sporting events will increase from 25 to 100 people per field or 30 percent capacity, whichever is less for indoor settings, and from 250 to 500 people per field or 30 percent capacity, whichever is less for outdoor settings.

- In-person graduation and commencement events: Last week, Governor Northam issued preliminary guidance on safe in-person graduations and commencements, which included a cap of 5,000 people or 30 percent of the venue capacity for outdoor events, whichever is less. Events held indoors may have up to 500 people, or 30 percent of the venue capacity, whichever is less. Attendees must wear masks and follow other guidelines and safety protocols to ensure proper distancing.

The full text of Fourth Amended Executive Order Seventy-Two and Order of Public Health Emergency Nine is available here. Updated guidelines for specific sectors can be found here. Visit virginia.gov/coronavirus/forwardvirginia for more information and answers to frequently asked questions.

Virginia has now administered more than 3.1 million doses of COVID-19 vaccine and is currently giving approximately 50,000 shots per day. Virginians are strongly encouraged to make sure they are pre-registered at vaccinate.virginia.gov, or by calling 877-VAX-IN-VA, to ensure that the Virginia Department of Health has all the relevant information to reach out when individuals are eligible to schedule vaccination appointments.

# # #

Full Release at https://www.governor.virginia.gov/newsroom/all-releases/2021/february/headline-892984-en.html.

Contacts: Office of the Governor: Alena Yarmosky, Alena.Yarmosky@governor.virginia.gov

Governor Northam Increases Capacity Limits for Outdoor Sports and Entertainment Venues as COVID-19 Hospitalizations and Infection Rates Continue to Fall, Vaccinations Rise

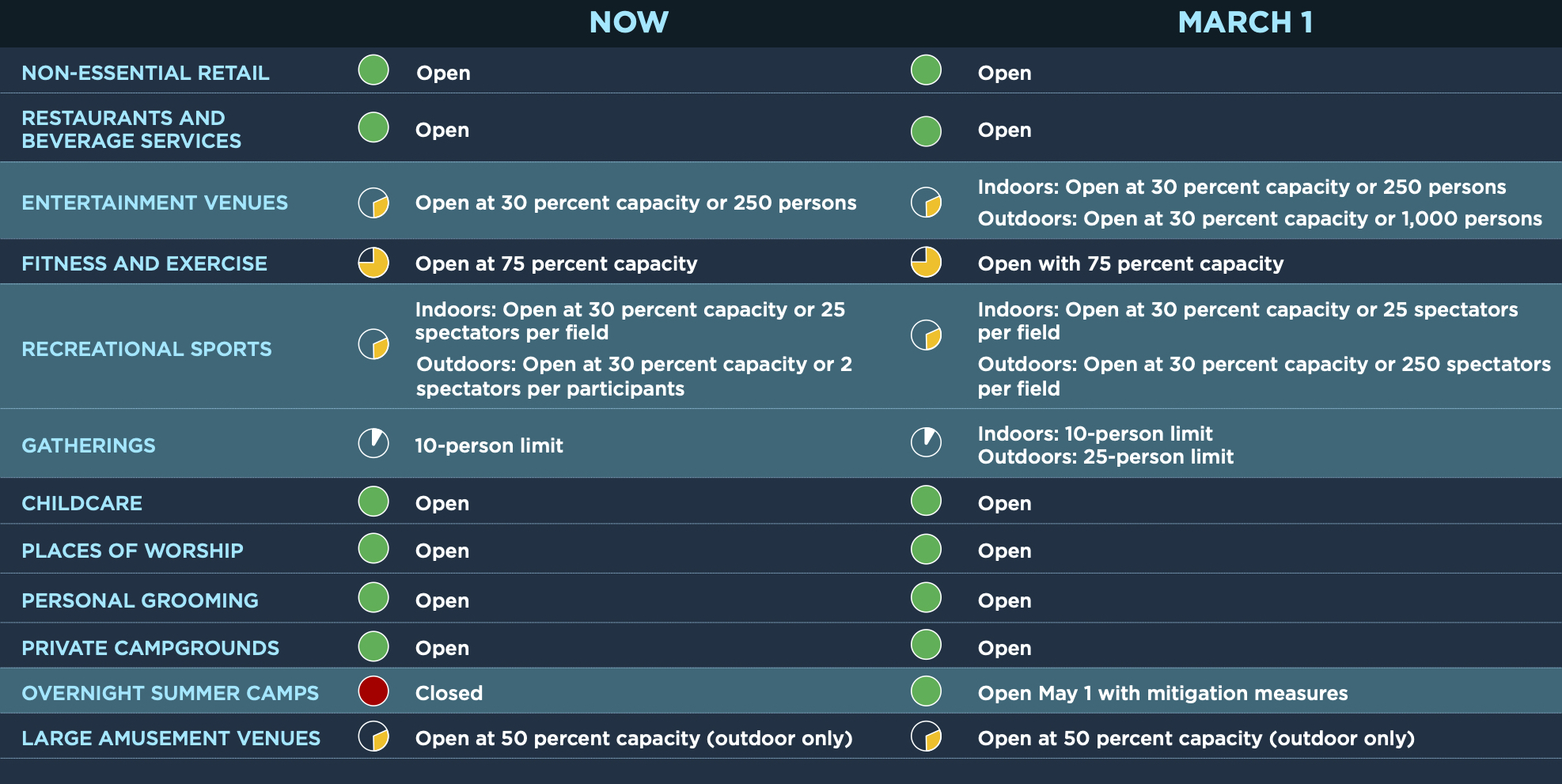

Indoor capacity limits to remain in place, overnight summer camps can open May 1 with mitigation measures

RICHMOND—Governor Ralph Northam today announced that as COVID-19 hospitalizations and infection rates continue to decline and vaccinations rise in Virginia, certain outdoor sports and entertainment venues may begin to operate at increased capacity starting Monday, March 1. He amended Executive Order Seventy-Two with the next steps of the “Forward Virginia” plan to safely and gradually ease public health restrictions while mitigating the spread of the virus.

“Thanks to the hard work and sacrifice of all Virginians, hospitalization and positivity rates across the Commonwealth are the lowest they have been in nearly three months,” said Governor Northam. “As key health metrics show encouraging trends and we continue to ramp up our vaccination efforts, we can begin to gradually resume certain recreational activities and further reopen sectors of our economy. Even as we take steps to safely ease public health guidelines, we must all remain vigilant so we can maintain our progress—the more we stay home, mask up, and practice social distancing, the more lives we will save from this dangerous virus.”

The Commonwealth will maintain a Safer at Home strategy with continued strict health and safety protocols including physical distancing, mask-wearing requirements, gathering limits, and business capacity restrictions. The current modified Stay at Home order will expire on February 28, 2021.

Governor Northam is beginning to ease public health restrictions by taking steps to increase capacity limits in outdoor settings, where evidence shows the risk of airborne transmission of COVID-19 is lower. The key changes in the Third Amended Executive Order Seventy-Two include:

- Social gatherings: The maximum number of individuals permitted in a social gathering will increase from 10 to 25 people for outdoor settings, while remaining at 10 persons for indoor settings.

- Entertainment venues: Outdoor entertainment and public amusement venues will be able to operate with up to 1,000 individuals or at 30 percent capacity, whichever is lower. If current trends continue, these venues may be able to operate at 30 percent capacity with no cap on the number of people permitted to attend starting in April. Indoor entertainment and public amusement venues must continue to operate at 30 percent capacity with a cap of 250 people. All entertainment venues were previously limited to a maximum of 250 individuals.

- Dining establishments: The on-site sale, consumption, and possession of alcohol will be permitted until midnight, extended from 10:00 p.m. All restaurants, dining establishments, food courts, breweries, microbreweries, distilleries, wineries, and tasting rooms still must be closed between midnight and 5:00 a.m.

- Overnight summer camps: As of May 1, overnight summer camps will be able to open with strict mitigation measures in place. Registration can begin now.

The new guidelines will be effective for at least one month and mitigation measures may be eased further if key health metrics continue to improve. Current guidelines for retail businesses, fitness and exercise, large amusement venues, and personal grooming services will remain in place. Individuals are strongly encouraged to continue teleworking if possible.

The full text of Third Amended Executive Order Seventy-Two and Order of Public Health Emergency Nine is available here. Updated guidelines for specific sectors can be found here.

Last week, Governor Northam amended Executive Order Seventy-Two to increase the number of spectators permitted at outdoor youth sporting events to 250.

Visit virginia.gov/coronavirus/forwardvirginia for more information and answers to frequently asked questions.

# # #

With general business and specific industry areas: https://www.virginia.gov/coronavirus/forwardvirginia/

Education and Training for the COVID-19 Emergency Temporary Standard, 16VAC25-220: https://www.doli.virginia.gov/covid-19-outreach-education-and-training/

DOLI Frequently Asked Questions: https://www.doli.virginia.gov/conronavirus-covid-19-faqs/

Helpful algorithm for evaluating employee symptoms and for making decisions about returning to work from the Virginia Department of Health: https://www.vdh.virginia.gov/content/uploads/sites/182/2020/09/Noncritical-Infrastructure-Worker-Algorithm.pdf

More than 1,000 Virginia business community members surveyed to develop “Blueprint” of best practices and recommendations to ensure consumer confidence and worker safety.

June 10, 2020 RICHMOND, VA – Earlier today, the Virginia Chamber of Commerce (Chamber) released its “Blueprint for Getting Virginians Back to Work” plan – a business-led effort to quickly provide guidance on how to get the Virginia economy moving again.

The Blueprint for Getting Virginians Back to Work provides guidance for businesses and policymakers as the Commonwealth moves beyond the term ‘essential business’ to fully reopen the economy. Intentionally named to complement the Chamber’s long-term business plan for Virginia – Blueprint Virginia 2025 – the Blueprint for Getting Virginians Back to Work provides a path forward that helps businesses with their immediate needs.

“As our government and business leaders consider how to best recover from the COVID-19 pandemic, it is important that they have the guidance to ensure consumer confidence and worker safety,” said Virginia Chamber President and CEO Barry DuVal. “The Chamber has launched this Blueprint for Getting Virginians Back to Work initiative to provide recommendations on operating in the current economic climate and how to return stronger than before. Through this effort, it is clear that business owners are reopening with the health and safety of Virginians as their top priority.”

In April and May, the Chamber engaged the business community through a series of surveys and roundtable discussions focused on cultivating input and best practices that are reflected in the final plan. More than 26,000 Virginia Chamber member companies, over 100 local chambers of commerce, industry trade associations and non-profits, and other key thought leaders from across the Commonwealth were among those invited to participate in this process.

The final plan, along with a host of other important resources for businesses, are available on the Chamber’s newly launched website www.GetVaBackToWork.com.

[Direct resources and Virginia cases by the numbers at https://getvabacktowork.com/covid-19-resource-center/]

Including industry specific guidelines: https://www.virginiasbdc.org/recoveryresourcecenter/

State and National Resources on COVID-19

Centers for Disease Control and Prevention (CDC) Website: https://www.cdc.gov/

Virginia Department of Health (VDH) Website: http://www.vdh.virginia.gov/

Press releases from the Virginia Governor: https://www.governor.virginia.gov/newsroom/news-releases/

Highland County, Virginia Resources on COVID-19

March 31, 2021

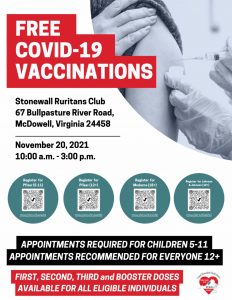

November 17, 2021

From the Highland County Public Library (https://www.facebook.com/HighlandCountyPublicLibrary):

McDowell, Highland County. Central Shenandoah Health District will be administering First, Second, Third booster Covid-19 doses of the Pfizer, Moderna, and Johnson and Johnson (vaccine administered to children 5-11 years old is the Pfizer vaccine), Saturday, November 20, at the Stonewall Ruritans Club, McDowell, 10 AM-3 PM. Appointments are required for children 5-11. Call Laura Lee Wight, 540-430-1699. Or schedule online https://bit.ly/3Dtqq4D Or see the flyer below for scannable QR code to schedule an appointment.

May 26, 2021 Update

From Highland Medical Center (https://www.facebook.com/HighlandMedicalCenter): We are happy to announce that we now have all 3 formulations of the COVID vaccine. We are now able to vaccinate all patients and residents ages 12 and older. We are working with Highland County Public Schools to offer Pfizer vaccines to children 12 and older.

Updates from the Highland Medical Center: https://www.facebook.com/HighlandMedicalCenter/

The Highland Helpline number is no longer active as of September 1, 2020.

Updates from the Highland Medical Center: https://www.facebook.com/HighlandMedicalCenter/

(3/26): WOF Food Bank have decided to have our food pantry during the coronavirus situation as it is an essential service to the county. We will only be having it one Saturday a month each month from 9am to 11am .

We will be doing this until covid-19 is lifted and everything goes back to normal. A grocery list will be given out at the mobile food bank the first Wednesday of each month. The regular food pantry will be drive up only and customers will be expected to line up behind the stop sign in front of the food pantry. Each person will stay in their vehicles for the entire time. The grocery list will be handed to the check in person. The list will be given to someone else to shop for you and load the groceries in your vehicle. This will protect them and our workers from any virus. Customers without lists will be given a list at food pantry times to fill out while while other customers are being shopped for. The next dates of our food pantry are May 9th, June 13th, July 11th. Please feel free to pass along to others that may not have Facebook.

Food Bank Word of Faith Church Office: 540-468-2592 or Jeff and Susan Grant: 540-396-4833.

To donate to the Food Bank, send check to:

Word of Faith Food Pantry

P.O. 276

Monterey, VA 24465

memo line – For Food Bank.

3/27/20 From MGW regarding Public Wi-Fi access in McDowell in Highland County:

In light of the school closings and impactful changes resulting from COVID-19, we at MGW have been working with our communities to provide “Drive-in” Public Wi-Fi access for students and citizens who might otherwise not have access because of their location or due to financial reasons. As many of you know, we partnered with The Highland County Chamber of Commerce and the Stonewall Ruritans to establish free wifi at the Ruritan Club for the Maple Festival- that service remains active and is available for immediate use. You’ll be glad to hear that despite the Maple Festival getting cancelled, we have had almost 200 gigs of traffic pass through that connection in the last few weeks. We believe the demand for internet connectivity is even more vital to the functioning of our communities as we navigate these unprecedented times.

We are asking that you help spread community awareness on the availability of this resource to the public. The Stonewall Ruritan Club has graciously supported this cause by allowing people to park outside the Ruritan building for Wi-Fi access. We are referring to this as “Drive-in” Public Wi-Fi because as you notify folks that this is available, we would recommend you remind them to remain in their vehicles while accessing the internet at these locations and respect all social distancing protocols.

We have named this connection “MGW Free Wi-fi” so any user would just need to search for that network in the wifi settings on their device and connect to it.

Learn more about other active MGW Wi-Fi sites at https://www.mgwnet.com/driveinwifi .

The Highland Center is offering free “drive-up” wireless internet from your vehicle in Monterey. You can use the following information to gain access:

WiFi Network: Center_Guest

Password: Reno2016

Please note that for the best signal, it is best to park next to the building. Thank you to The Highland Center!

5/19/20 The Community Foundation of the Central Blue Ridge wants to know what matters most to YOU, particularly during these difficult times. One way your Community Foundation serves you is by getting financial resources to the organizations that can help you. We hear from them regularly, but it is important that they also hear directly from YOU. Complete the brief survey here: https://cfcbr.org/survey/

Economic Relief and Opportunities

The Community Foundation Opens 2022 Little Swiss Fund Grant Applications on July 1

The Community Foundation of Harrisonburg and Rockingham County (TCFHR) competitive grant application cycle will be open to eligible Highland County nonprofit organizations starting on Friday, July 1. The application deadline is Thursday, September 1. Using our new competitive grant software system, nonprofit organizations can easily create an account to submit grant applications. All Little Swiss Fund grant awards will be distributed by the end of the calendar year. Your organization can log in and create an account in our grants system HERE.

In Fall 2021, The Community Foundation of Harrisonburg and Rockingham County distributed $334,821 from the Little Swiss Fund to 17 Highland County nonprofit organizations. We expect the total grant funding to be more this year.

For questions, please call TCFHR at 540-432-3863, visit www.tcfhr.org, or email me. Organizations must be tax-exempt public charities under IRS Section 501(c)3 or other nonprofit status. Nonprofits physically located in, and serving, Highland County, with broad active volunteer support and annual revenues exceeding $25,000 are encouraged to apply. Organizations must receive less than half their income from government entities to be eligible. Religious organizations serving Highland County may also apply. Schools are not eligible to apply. Grants are made without regard to factors of gender, race, religion, national origin, or sexual orientation.

About The Community Foundation of Harrisonburg & Rockingham County

The Community Foundation of Harrisonburg and Rockingham County makes it easy to give back to the community we love.

Senior Cool Care: Fans and air conditioners are available, for eligible adults, age 60 and older, who need additional cooling in their homes. Program runs from May 1 through October 31, 2022. Eligibility: Adults 60 years of age and older: If you live in Buena Vista, Lexington, Rockbridge, Bath or Highland County and your monthly income is $1,699 (single) or $2,289 (couple), you may be eligible for a single room air conditioner or a fan. Sponsored by Dominion Energy and managed by Department for Aging and Rehabilitative Services- Office for Aging Services. Administered by VPAS. Supplies are limited. To apply, call VPAS: 540-468-2178. https://www.vpas.info/

Community Foundation of the Central Blue Ridge Community Grants Program

Thank you for your interest in applying for a grant from the Community Foundation of the Central Blue Ridge. The deadline for this application is February 11, 2022 at 11:59 p.m. EST.

Eligible grant recipients include tax-exempt 501(c)(3) charitable organizations, as well as organizations operating under the fiscal sponsorship of a 501(c)(3) charitable organization, that serve the independent cities of Staunton and Waynesboro, the counties of Augusta, Highland, and Nelson. We do not issue grants to individuals, fraternal organizations, or sectarian organizations.

While the Community Foundation does not have specific funding priorities for its Community Grants program, we do favor organizations and programs that:

- Address identified community needs and/or opportunities, and

- Are well-conceived with a realistic schedule of activities and thoughtful use of resources.

The Foundation does not provide grants for deficit reduction or endowments.

In 2021, the Foundation issued 121 grants totaling $423,000 through our Community Grants program. Grant awards ranged from $1,000-10,000. The average grant amount was $3,500.

For full details and to apply, please go to cfcbr.org/community-grants-program/.

2022 Youth Philanthropy Council Grant Application

The Community Foundation established its Youth Philanthropy Council (YPC) in 2008 to provide opportunities for local youth to practice philanthropic leadership skills. We believe that by including the voices and opinions of local youth in our community conversations, we can better understand our community while fostering in our future leaders a sense of local stewardship.

This year, the YPC is composed of 16 sophomores, juniors, and seniors from the local public and private high schools in Staunton, Waynesboro, and Augusta County. Together they form a grant making body that regularly meets throughout the school year to learn about the grant making process and the social sector. They are given agency by our community foundation to create their own funding priority, ask in their grant application questions that they want answers for, and together make all of the funding decisions. This is a "teaching application" for them and for us.

Our SAW Youth Philanthropy Council Grants are available only to organizations that serve Staunton, Waynesboro, and Augusta County.

For full details and to apply, please visit app.smarterselect.com/programs/78155-Community-Foundation-Of-The-Central-Blue-Ridge.

May 5, 2021: From the Central Shenandoah Planning District Commission:

There are several funding programs that are currently accepting applications. You may find these programs, as well as other grant opportunities, posted on the CSPDC’s online Grant Resource Guide.

Virginia Eviction Reduction Pilot (VERP) Planning Grant

Virginia Department of Housing and Community Development

The Virginia Department of Housing and Community Development (DHCD) is now accepting applications for the Virginia Eviction Reduction Pilot (VERP) Planning Grant. The VERP Planning Grant program is designed to aid localities and nonprofits to better understand eviction prevention needs and to build capacity to mitigate evictions. The goal of the Planning Grants is to prepare Grantees for a future VERP application. Application Deadline: May 26, 2021

Distance Learning and Telemedicine (DLT)

USDA-Rural Development

The United States Department of Agriculture (USDA) Rural Development is accepting applications for Distance Learning and Telemedicine (DLT) program grants to help fund distance learning and telemedicine services in rural areas to increase access to education, training, and health care resources that are otherwise limited or unavailable. Application Deadline: June 4, 2021

Virginia Tourism Corporation (VTC) Recovery Marketing Leverage Program Summer 2021

Virginia Tourism Corporation

Virginia Tourism is offering these marketing grant funds to spur economic activity and travel across the Commonwealth. Applications open May 11, 2021. Application Deadline: June 22, 2021

GO Virginia Region 8 Per Capita and Enhanced Capacity Building Programs

Virginia Department of Housing and Community Development

Administered through the Virginia Department of Housing and Community Development, GO Virginia supports programs to create more high-paying jobs through collaboration between business, education, and government to diversify and strengthen the economy in every region of the Commonwealth. CSPDC localities are part of GO Virginia Region 8. The Region 8 Council receives and considers projects that support one of the following: workforce development, site development, startup ecosystems, or cluster scale-ups. The Region 8 Council will consider funding for (1) implementation projects or (2) enhanced capacity building activities such as an assessment or planning study that leads to project development and implementation. GO Virginia 8 applications are accepted quarterly. Contact CSPDC staff if interested in this program. Next Application Deadline: June 25, 2021

GO Virginia Region 8 Economic Resilience and Recovery (ERR) Program

Virginia Department of Housing and Community Development

The GO Virginia ERR program helps to build capacity to support and serve existing businesses, priority traded sectors and essential businesses, including the healthcare system and its supply chain during the pandemic. The ERR initiative focuses resources on economic resiliency and recovery while following the mission of the overarching GO Virginia program. CSPDC localities are part of GO Virginia Region 8. ERR applications to GO Virginia Region 8 are received and considered on a rolling basis. Contact CSPDC staff if interested in this program. Application Deadline: Rolling

Recreational Trails Program (RTP)

Virginia is the Department of Conservation and Recreation

The Recreational Trails Program is a matching reimbursement program for building and rehabilitating trails and trail facilities and land acquisition for trail projects. The Federal Highway Administration provides the program's funding. The agency responsible for administering the program in Virginia is the Department of Conservation and Recreation (DCR). Application Deadline: June 30, 2021

Virginia is the Department of Conservation and Recreation

The Trail Grants program is a 100% reimbursement program being offered in 2021 for trail projects that increase access to trail opportunities for people with disabilities. Application Deadline: June 30, 2021

T-Mobile

T-Mobile has partnered with Smart Growth America and Main Street America to help build stronger, more prosperous small towns and rural communities. The T-Mobile Hometown grant program will help fund projects to build, rebuild, or refresh community spaces that help foster local connections. For example, this might include the town square pavilion, a historic building, an outdoor park, a ball field, or a library - a place where friends and neighbors connect. Applications accepted quarterly; portal closes on the last day of each quarter and reopens for the new quarter on the first of the month. Next Application Deadline: Summer quarter applications due June 30

Virginia Department of Housing and Community Development

The Virginia Department of Housing and Community Development (DHCD) is now accepting applications for the Acquire, Renovate, Sell (ARS) program. The ARS program strives to create affordable homeownership opportunities for low-to-moderate income (LMI), first-time homebuyers by renovating previously undervalued homes, while allowing providers increased discretion over acquisition type, region and resale. Application Deadline: Rolling basis until July 25, 2021

Virginia Telecommunication Initiative (VATI)

Virginia Department of Housing and Community Development

Administered by the Virginia Department of Housing and Community Development (DHCD), the primary objective of the Virginia Telecommunication Initiative (VATI) is to provide financial assistance to supplement construction costs by private sector broadband service providers, in partnership with local units of government, to extend last-mile service to areas that presently are unserved by any broadband provider. Applications open June 17, 2021. Notice of applications due July 27. Applications due September 14, 2021. Full timeline and draft guidelines available at https://www.dhcd.virginia.gov/vati.

Industrial Revitalization Fund (IRF)

Virginia Department of Housing and Community Development

The IRF program supports the strategic redevelopment of vacant and deteriorated industrial properties across the Commonwealth. Funding may be used for a wide variety of revitalization and redevelopment activities such as acquisition, rehabilitation, or repair (including securing and stabilizing for subsequent reuse) of specific structures, as well as demolition, removal, and other physical activities. Application Deadline: July 30, 2021

Virginia Community Development Block Grant (CDBG) Program – Open Submission Programs

Virginia Department of Housing and Community Development

Planning Grants, Economic Development & Entrepreneurship Fund, Construction-Ready Water and Sewer Fund, and Regional Water/Wastewater Fund projects will receive funding on an open, first-come, first-served basis between April 1, 2021 and December 31, 2021. Projects meeting one or more CDBG national objectives and program criteria will be offered an award as long as funds are still available. Application Deadline: Rolling April 1-December 31, 2021

Community Heart and Soul Seed Grant Program

Community Heart and Soul

This program provides $10,000 in startup funding for resident-driven groups in small cities and towns to implement the Community Heart & Soul model. Grant funding requires a $10,000 cash match from the participating municipality or a partnering organization. Application Deadline: Rolling

May 10, 2021 from the Virginia Department of Social Services:

Do you need help with child care due to work, job search, work-related training or education? The Child Care Subsidy Program has temporarily expanded eligibility through July 31, 2021 to offer financial assistance to more families than ever before. Visit ChildCareVa.com to learn more.

April 23, 2021

The American Rescue Plan Act established the Restaurant Revitalization Fund (RRF) to provide funding to help restaurants and other eligible businesses keep their doors open. This program will provide restaurants with funding equal to their pandemic-related revenue loss up to $10 million per business and no more than $5 million per physical location. Recipients are not required to repay the funding as long as funds are used for eligible uses no later than March 11, 2023.

Full details at https://www.sba.gov/funding-programs/loans/covid-19-relief-options/restaurant-revitalization-fund.

There are many webinars about the RRF you can register for at https://www.sba.gov/offices/district/va/richmond - just click "Show Entire Month" on their calendar for April 2021.

The CSPDC Recovery Dashboard tracks the impacts of COVID-19 and regional recovery efforts across the Central Shenandoah Valley Region. Learn valuable information specific to Highland County, as well as surrounding areas, on stats like Lodging Tax Revenues, Local Sales Tax Revenue, COVID-19 Vaccinations and more! https://www.cspdc.org/covid19-recovery/

3/31/21 From ASAE: The Center for Association Leadership:

PPP Extended

Yesterday, President Biden signed into law the two-month extension to apply for a Paycheck Protection Program (PPP) loan. As a refresher, the legislation extends PPP through May 31 and allows 501(c)(6) organizations and others more time to pursue a second PPP loan. Further, if eligible organizations apply by May 31, the Small Business Administration will permit lenders an additional 30 days to process and approve any outstanding applications.

Eligibility criteria for a second PPP loan are as follows:

- The applicant received a first PPP loan and will or has used the loan only for authorized uses;

- The applicant employs no more than 300 people; and

- The applicant can demonstrate at least a 25-percent reduction in gross receipts between comparable quarters in 2019 and 2020.

The maximum loan amount of a second PPP loan is two-and-a-half times the average monthly 2019 or 2020 payroll costs, up to $2 million.

-

Full details about the SBA Paycheck Protection Program are available at https://www.sba.gov/funding-programs/loans/covid-19-relief-options/paycheck-protection-program.

Small Business Administration:

Shuttered Venue Operators Grants (SVOG) Program

Monday, April 5th

2-3pm ET

Register by clicking here now

LISC will be holding a webinar on Small Business Administration’s newly created Shuttered Venue Operators Grants (SVOG) Program. The SBA is expected to start accepting applications for the program on April 8th, with awards being provided on a rolling basis. This webinar will provide information on program eligibility and application preparation, with an emphasis on helping venues in underserved communities prepare for rollout through actionable steps and best practices.

The SBA is holding webinars to cover the basics of the program, as well as applicant eligibility and requirements. You can view all upcoming events and webinars here. They have also launched a splash page for the Shuttered Venue Operators Grant application portal in anticipation of opening grant applications for the critical economic relief program. You can visit the SVOG portal here.

Moderator -

• Bill Taft, Senior Vice President, LISC Economic Development

Panelists -

• Michelle Harati, Policy Officer, LISC Policy

• Karleen Porcena, Senior Program Officer, LISC Economic Development

• Sean Watterson, Happy Dog Venue Owner, and Co-Chair of the National Independent Venue Association (NIVA) Implementation Task Force

Telework!VA is your one-stop resource for businesses, agencies and employees looking to learn more about telework or how to implement a successful telework program.

Here’s how they help employers:

- Establish tailored telework policies and staff agreements to promote a sustainable program

- Assess and evaluate your existing telework program

- Help your business formalize a management and operations model that includes telework

- Provide FREE virtual training for managers and employees

- Create and streamline budget plans

- Provide guidance on telework related technologies

Learn more at http://teleworkva.org/.

On December 21, 2020, Congress passed the Coronavirus Response and Relief Supplemental Appropriations Act, 2021 (H.R. 133) to provide more than $900 billion in emergency assistance for individuals, families, nonprofits and businesses impacted by the COVID pandemic.

From the US Chamber of Commerce: Guide to Small Business COVID-19 Emergency Loans:

What Small Businesses Need to Know About the New Pandemic Relief Package – Changes to PPP and More:

https://www.uschamber.com/report/guide-small-business-covid-19-emergency-loans

1/6/21: Dominion Energy is partnering with the Virginia Chamber of Commerce Foundation to temporarily expand its EnergyShare program to assist those small businesses impacted by the COVID-19 pandemic. Dominion Energy Virginia is pledging $500,000 to help provide energy bill relief for small businesses, nonprofits, and houses of worship in its Virginia service territory. The program funding will be covered by shareholders and will not impact customer rates. Qualified businesses may be eligible for one-time assistance with their Dominion Energy electric bill up to $1,000. Learn more about eligibility requirements and applications at http://www.vachamber.com/foundation/small-business-relief-program/

Are you or someone you know late on your rent or mortgage? You may qualify for the Virginia Rent and Mortgage Relief Program, which offers financial assistance for payments past due beginning April 1, 2020 and onward. Find out if you’re eligible by visiting dhcd.virginia.gov/eligibility or by calling 2-1-1.

Commonwealth of Virginia

Office of Governor Ralph S. NorthamFOR IMMEDIATE RELEASE · October 28, 2020

Office of the Governor

Alena.Yarmosky@governor.virginia.gov

Governor Northam Invites Small Businesses and Nonprofits to Apply for Up to $100,000 from Rebuild VA Grant Fund

~ Program allotted additional $30 million, eligibility expanded ~

RICHMOND—Governor Ralph Northam today announced that Rebuild VA, a grant program to help small businesses and nonprofit organizations affected by the COVID-19 pandemic, will expand eligibility criteria and increase the amount of grant money businesses receive.

Rebuild VA launched in August with $70 million from the federal Coronavirus Aid, Relief, and Economic Security (CARES) Act. Governor Northam is directing an additional $30 million to support the expansion of the program. Businesses with less than $10 million in gross revenue or fewer than 250 employees will be eligible under the new criteria, and the maximum grant award will increase from $10,000 to $100,000.

“We started Rebuild VA to help small businesses and nonprofit organizations navigate the impacts of the COVID-19 pandemic,” said Governor Northam. “These changes to the program will ensure that we can provide additional financial assistance to even more Virginians so they can weather this public health crisis and emerge stronger.”

Rebuild VA will now be open to all types of Virginia small businesses that meet size and other eligibility requirements, from restaurants and summer camps, to farmers and retail shops. Businesses that previously received a Rebuild VA grant will receive a second award correlated with the updated guidelines.

Rebuild VA is administered by the Department of Small Business and Supplier Diversity (SBSD) in partnership with the Department of Housing and Community Development and the Virginia Tourism Corporation, and the Virginia Economic Development Partnership. Eligible businesses and nonprofits must demonstrate that their normal operations were limited by Governor Northam’s Executive Orders Fifty-Three or Fifty-Five, or that they were directly impacted by the closure of such businesses. In September, the program expanded eligibility to supply chain partners of businesses whose normal operations were impacted by the pandemic.

Rebuild VA funding may be utilized for the following eligible expenses:

• Payroll support, including paid sick, medical, or family leave, and costs related to the continuation of group health care benefits during those periods of leave;

• Employee salaries;

• Mortgage payments, rent, and utilities;

• Principal and interest payments for any business loans from national or state-chartered banking, savings and loan institutions, or credit unions, that were incurred before or during the emergency;

• Eligible personal protective equipment, cleaning and disinfecting materials, or other working capital needed to address COVID-19 response.

For additional information about Rebuild VA and how to submit an application, please visit https://www.governor.virginia.gov/rebuildva/

###

Nonprofit Roanoke is distributing FREE PROTECTIVE MASKS for nonprofit organization staff and volunteers in Virginia Department of Emergency Management’s REGION 6*, in partnership with the Federal Emergency Management Administration (FEMA) and VA Voluntary Organizations Active in Disaster (VA VOAD). Please see the following link with a Google survey to learn more and apply: https://airtable.com/shrFFLj7gWI8N7iSV

The original link: https://www.ssa.gov/coronavirus/eip/?utm_campaign=ocomm-eip-20&utm_content=eip-email-cta&utm_medium=email&utm_source=govdelivery.

Attention SSI and other federal benefit recipients who did not file 2018 or 2019 tax returns and who have qualifying children under 17 – It’s not too late! Take Action Now!

The IRS has extended deadlines to help children and adults get their Economic Impact Payments (EIP) by using its Non-Filer Tool.

• You must act by September 30th to get $500 EIPs for your child this year.

• Most adult Social Security and SSI beneficiaries have already received their EIPs. Adults who started receiving their monthly Social Security or SSI payment on or after January 1, 2020 should receive their $1,200 EIP from the IRS on or by November 6, 2020 without taking action with the IRS. Other adult federal benefit recipients must act by October 15th to get their $1,200 EIP this year.

Please read the latest from the IRS and take action now if appropriate.

https://www.irs.gov/newsroom/irs-takes-new-steps-to-ensure-people-with-children-receive-500-economic-impact-payments

The Coronavirus Aid, Relief, and Economic Security (CARES) Act of 2020 provided $900 million of supplemental Low-Income Home Energy Assistance Program (LIHEAP) funding to assist households impacted by COVID-19. Through this funding, the Virginia Department of Social Services (VDSS) received $23,356,803, which will be utilized to support the new COVID-19 Energy Assistance Program and provide other energy assistance resources.

The new program will assist low-income households that would not typically be eligible for other energy assistance programs (Fuel, Crisis, and Cooling Assistance) offered by the Virginia Department of Social Services. Eligible households will receive a one-time payment of $300 to address their immediate energy costs, including energy debt accumulated during the COVID-19 pandemic.

Households that received Fuel, Crisis, or Cooling assistance (except equipment-related services) from VDSS within the 12 months are not eligible to receive COVID-19 Energy Assistance Program benefits. However, households may qualify for other heating assistance through the Department’s normal Fuel Assistance application process, which begins October 13 and ends November 13.

Applications will be accepted through November 20, 2020 or until funds are exhausted, whichever comes first. Applications may be submitted online from the COVID-19 Virginia Resources website at https://covid.virginia.gov/ or through the COVID-19 Virginia Resources mobile app that can be downloaded from through the App Store or Google Play. All questions about applying should be referred to 1-833-829-2767.

Eligibility criteria for assistance includes:

• Must be a resident of Virginia

• Must have a heating or cooling expense responsibility

• Must be either a United States citizen or an eligible immigrant

• A household’s monthly gross income must be less than the maximum allowed for the number of people in the home:

Household Size Maximum Income

1 $2,720

2 3,558

3 4,395

4 5,232

5 6,069

6 6,907

Each Additional Member Add $156

For additional information regarding the COVID-19 Energy Assistance Program and other available energy assistance resources, visit dss.virginia.gov/benefit/ea/ or contact the dedicated energy assistance line at 1-833-829-2767.

You may also apply at https://vaservices.dss.virginia.gov/CARES/

The following is an opportunity to provide comments about adding an additional commodity (such as maple syrup) to be considered in the Coronavirus Food Assistance Program (CFAP) to potentially provide future financial relief. Comments on additional commodities will be received by June 22, 2020. Full details can be found at https://www.regulations.gov/document?D=FSA-2020-0004-0003. Comments can be made by clicking the upper right “Comment Now” button.

As part of the efforts to continue to mitigate and respond to the pandemic, the Virginia Department of Health (VDH) is hiring temporary contractors in a variety of positions to aid in the COVID-19 response. VDH started hiring for contract positions in May, and while many positions have been filled, there is still a need to hire people for the following positions:

- COVID-19 case investigator

- COVID-19 contact tracer

- COVID-19 testing coordinator

- COVID-19 regional containment advisors

- COVID-19 data manager

- COVID-19 analytics coordinator

These positions are temporary (6+ months) and are 32- 40 hours a week with competitive pay. Applicants must be willing and able to work weekends as needed. Hired contractors will be able to work remotely but will be asked to come to district offices as needed. No public health or healthcare experience required for contact tracer positions.

Attached to this email is more information on how to apply for these positions. [INSERTED HERE: Staffing-Agency-List] Please forward this email to anyone you think might be interested in any of these positions. Please note that applicants should only apply for these positions through ONE staffing agency of their choosing.

If you or anyone else has any questions, please feel free to contact me or share my contact information with interested applicants.

Thank you for the help in spreading the word about this opportunity to our community.

Have a good weekend and stay well,

Laura Lee Wight

Health Educator | Central Shenandoah Health District

1414 N. Augusta Street | P.O Box 2126 | Staunton, VA 24402

Cell: 540-430-1699 | Office: 540-332-7830 ext. 344

Preferred Pronouns: she/her/hers

SCORE has many free webinars that may be helpful to navigate the current business climate at https://www.score.org/recorded-webinars, with topics such as “10 Principles to Running a Virtual Company Extremely Well”, “A Smarter Approach to Your COVID Marketing Strategy” or “The 4 Key Things Business Owners Should Be Focused on Right Now”. You can watch these webinars live, too!

Dear Friends, We are pleased to share the following announcement and call for proposals on behalf of CAPSAW:

CAPSAW has been allocated supplemental Community Services Block Grant (CSBG) funding to address COVID-19 related needs through the Coronavirus Aid, Relief, and Economic Security (CARES) Act. All funds are for services to individuals and families at or below 200% of the Federal Poverty Line residing in Staunton, Augusta County, or Waynesboro. All proposals must be received, via valleycapsaw@gmail.com by 5pm on the first Friday of each month. Proposals will be reviewed until funding has been allocated. Please direct any and all questions to Anna Leavitt (valleycapsaw@gmail.com).

Click here to access the COVID Response Funding Request Application (Word Document Download)

Information on the Small Business Administration (SBA) Loans, including the Paycheck Protection Program and Economic Injury Disaster Loans and Loan Advance:

https://www.sba.gov/funding-programs/loans/coronavirus-relief-options

Some of this is time-sensitive. Learn more at https://mailchi.mp/thecne/time-sensitive-financial-support-available-to-nonprofits?e=9c2e0078c3

For more assistance on filling out the SBA Loans, please contact Betty M. Mitchell, Highland Economic Development Officer

540-383-9415 (cell) or 540-474-3333 (home)

From 3/19/20:

The handout “SBA Disaster Assistance in Response to the Coronavirus” located by clicking HERE is the 1-page overview for businesses (3.75% interest) and private nonprofits (2.75% interest) that may be eligible under this U.S. Small Business Administration (SBA) program. There is a long list of entities not eligible under this program – most relevant to our area would be farmers, churches, and local governments.

During the almost 2 hour webinar in which I participated yesterday, there were lots of tips given related to the application that do not show up on the website. That said, I’ve added the highlandeda@htcnet.org email to the bottom of the handout. If someone needs help with the application, we can direct them to resources and share more forms and information.

I’ve reached out to our two local banks; talked to one and waiting for a call back from another. The feds have loosened some regulations for Community Banks, so customers who need financing are encouraged to call their local lenders and talk to them. I’ve sent info about this program to them, so that if the Bank can’t help, the Loan Officers are aware of this resource.

There are no fees to apply for this direct SBA funding, just the business’ time. Once an application is COMPLETE, loan decisions can be made within 21 days. Learn more from the SBA at https://www.sba.gov/.

There is also a recorded presentation on filling out the SBA EIDL Application that will cover the same EIDL application overview: https://vccs.zoom.us/rec/play/7JB8cbypqjo3S93A5QSDB_cqW465LaKs0SIbqPVZxEnmUnFRZ1rwMuNBNuCL-OOwBuzaQZSyXq31vV2k?continueMode=true

RestoreYourEconomy is your resource for up-to-date information related to COVID-19 and its economic impacts. It is managed by the International Economic Development Council (IEDC) with generous support from the U.S. Economic Development Administration and IEDC’s Economic Development Research Partners program. https://restoreyoureconomy.org/

Immerge has put together this directory of local Shenandoah Valley Businesses to support them during this time. The Business Listing contains local businesses in the Shenandoah Valley of Virginia. This includes Augusta, Clarke, Frederick, Page, Rockbridge, Rockingham, Shenandoah, Warren, Highland, and Bath Counties: https://www.shoplocalshenvalley.com/

If you would like your business listed on the site, use the Submit Info form: https://www.shoplocalshenvalley.com/submit

#TheValleyStrong is an initiative being coordinated by the Harrisonburg Radio Group: https://thevalleystrong.com/. Businesses have the opportunity to add their business listing to become part of the Business Resource Directory and the Harrisonburg Radio Group has produced PSAs for this program. Their territory covers Shenandoah, Page, Rockingham, Harrisonburg, Staunton, Augusta, Waynesboro and Highland. Submit your business at https://thevalleystrong.com/add-listing/

Some people will receive their Stimulus Check on a prepaid debit card if the IRS couldn’t direct deposit the payment. This may be unexpected and the recipient may throw it away, thinking it a scam. Below is an email with a good link describing how to use the debit card, in case you get calls. From the document:

I received an Economic Impact Payment VISA prepaid debit card from the government in the mail. Is this a scam?

This is not a scam. The government is sending some people Economic Impact Payment Cards if they qualified for a stimulus payment and the IRS couldn’t direct deposit the payment.

Your Economic Impact Card will come in a plain envelope from “Money Network Cardholder Services” along with important information about the card, instructions for activation, fees, and a note from the U.S. Treasury. The card itself will have the words “VISA” and “DEBIT” on the front and the issuing bank, “MetaBank, N.A.”, on the back and should look like this:

Here is the reference from the IRS website:

Here is the reference from the IRS website:

A45. Some payments may be sent on a prepaid debit card known as The Economic Impact Payment Card The Economic Impact Payment Card is sponsored by the Treasury Department’s Bureau of the Fiscal Service, managed by Money Network Financial, LLC and issued by Treasury’s financial agent, MetaBank®, N.A.

If you receive an Economic Impact Payment Card, it will arrive in a plain envelope from “Money Network Cardholder Services.” The Visa name will appear on the front of the Card; the back of the Card has the name of the issuing bank, MetaBank®, N.A. Information included with the Card will explain that the card is your Economic Impact Payment Card. Please go to EIPcard.com for more information.

Treasury, IRS launch new tool to help non-filers register for Economic Impact Payments

IRS.gov feature helps people who normally don’t file get payments; second tool next week provides taxpayers with payment delivery date and provide direct deposit information

WASHINGTON – To help millions of people, the Treasury Department and the Internal Revenue Service today launched a new web tool allowing quick registration for Economic Impact Payments for those who don’t normally file a tax return.

The non-filer tool, developed in partnership between the IRS and the Free File Alliance, provides a free and easy option designed for people who don’t have a return filing obligation, including those with too little income to file. The feature is available only on IRS.gov, and users should look for Non-filers: Enter Payment Info Here to take them directly to the tool.

“People who don’t have a return filing obligation can use this tool to give us basic information so they can receive their Economic Impact Payments as soon as possible,” said IRS Commissioner Chuck Rettig. “The IRS and Free File Alliance have been working around the clock to deliver this new tool to help people.”

The IRS reminds taxpayers that Economic Impact Payments will be distributed automatically to most people starting next week. Eligible taxpayers who filed tax returns for 2019 or 2018 will receive the payments automatically. Automatic payments will also go in the near future to those receiving Social Security retirement or disability benefits and Railroad Retirement benefits.

How do I use the Non-Filers: Enter Payment Info tool?

For those who don’t normally file a tax return, the process is simple and only takes a few minutes to complete. First, visit IRS.gov, and look for “Non-Filers: Enter Payment Info Here.” Then provide basic information including Social Security number, name, address, and dependents. The IRS will use this information to confirm eligibility and calculate and send an Economic Impact Payment. Using the tool to get your payment will not result in any taxes being owed. Entering bank or financial account information will allow the IRS to deposit your payment directly in your account. Otherwise, your payment will be mailed to you.

“Non-Filers: Enter Payment Info” is secure, and the information entered will be safe. The tool is based on Free File Fillable Forms, part of the Free File Alliance’s offerings of free products on IRS.gov.

Who should use the Non-Filers tool?

This new tool is designed for people who did not file a tax return for 2018 or 2019 and who don’t receive Social Security retirement or disability benefits or Railroad Retirement benefits. Others who should consider the Non-Filers tool as an option, include:

Lower income: Among those who could use Non-Filers: Enter Payment Info tool are those who haven’t filed a 2018 or 2019 return because they are under the normal income limits for filing a tax return. This may include single filers who made under $12,200 and married couples making less than $24,400 in 2019.

Veterans beneficiaries and Supplemental Security Income (SSI) recipients: The IRS continues to explore ways to see if Economic Impact Payments can be made automatically to SSI recipients and those who receive veterans disability compensation, pension or survivor benefits from the Department of Veterans Affairs and who did not file a tax return for the 2018 or 2019 tax years. People in these groups can either use Non-Filers: Enter Payment Info option now or wait as the IRS continues to review automatic payment options to simplify delivery for these groups.

Social Security, SSDI and Railroad Retirement beneficiaries with qualifying dependents: These groups will automatically receive $1,200 Economic Impact Payments. People in this group who have qualifying children under age 17 may use Non-Filers: Enter Payment Info to claim the $500 payment per child.

Students and others: If someone else claimed you on their tax return, you will not be eligible for the Economic Impact Payment or using the Non-Filer tool.